Go-To-Market Due Diligence

Make GTM Due Diligence Your Competitive Edge.

In today's market, organic growth assumptions drive valuations, but blind spots in Go-To-Market strategy can quickly destroy the value. Craig Group's GTM Due Diligence gives private equity firms the confidence to close deals by uncovering critical revenue risks and validating growth potential sooner, not later.

Why Consider GTM Due Diligence?

Surface critical revenue risks before deals close

Address the blind spots in commercial due diligence

Validate organic growth assumptions baked into the model

Identify GTM execution gaps and capability shortfalls

Go beyond Quality of Earnings to predict the scalability of the current revenue engine

Avoid post-close surprises in pipeline, churn, pricing, and GTM talent

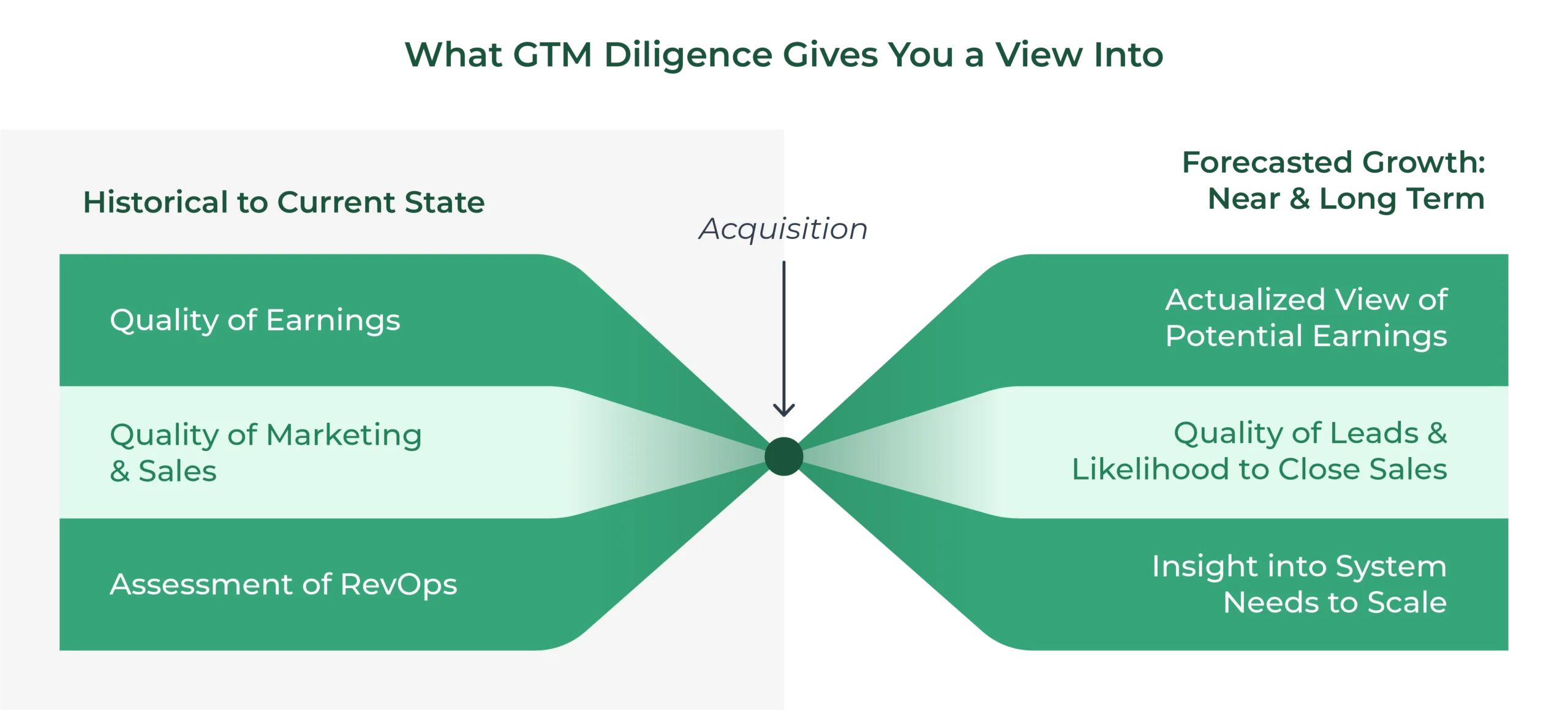

GTM Diligence Gives you Growth Insights

Be Confident in Your Investment...

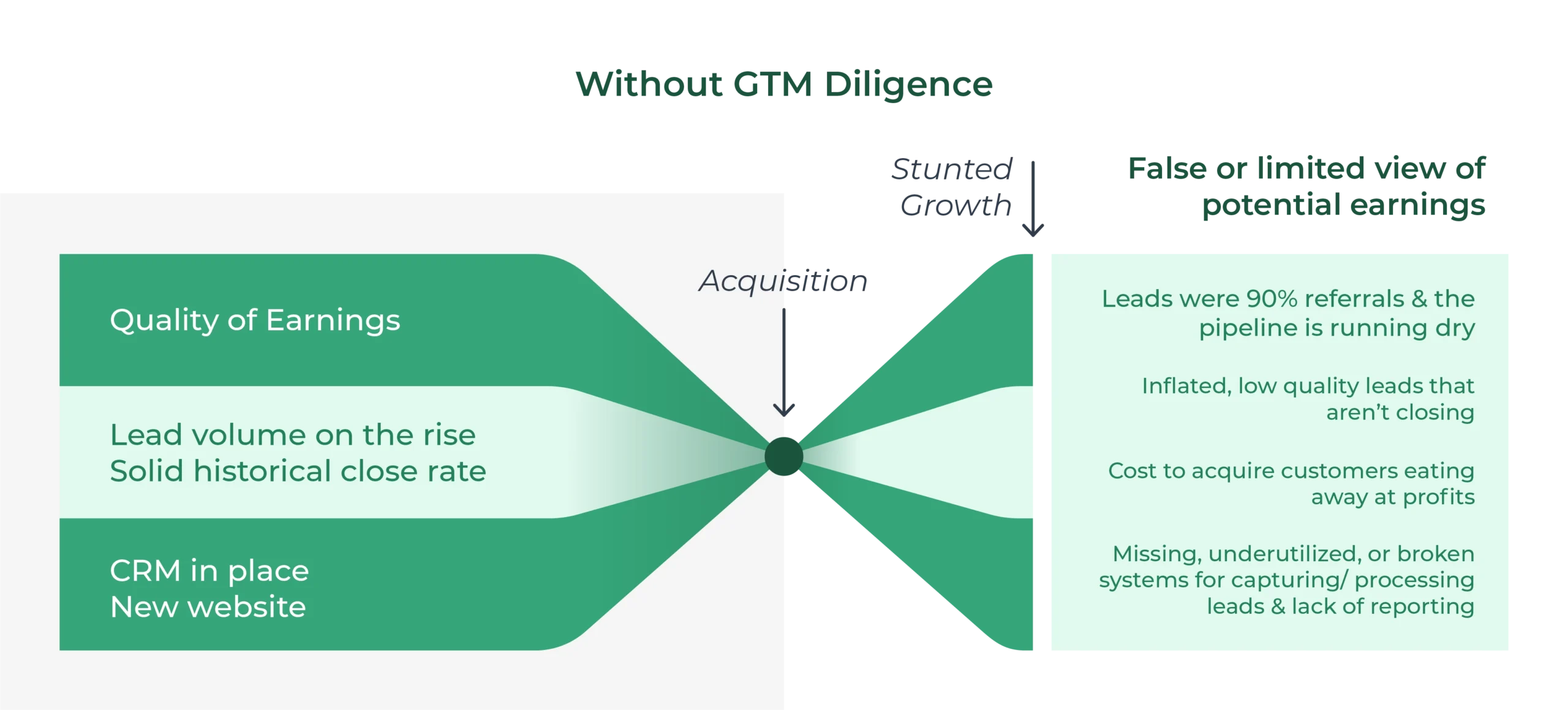

Many PE firms rely on financial due diligence alone, leaving massive GTM risks undetected. Overestimated conversion rates, founder-dependent sales processes, and fragmented go-to-market strategies can derail growth plans and erode valuations.

You need visibility into what's really driving—or limiting—revenue growth.

...and Its Capacity to Grow.

Craig Group's GTM Due Diligence Service fits seamlessly into your deal timeline with a rapid 2–3 week sprint that delivers maximum insight with minimal disruption. Our comprehensive process includes:

Audit of current GTM motions across marketing, sales, and customer success

Customer, pipeline, and rep performance analysis using data room insights and competitive intelligence

Voice-of-customer and front-line team interviews to uncover hidden operational issues

Clear risk assessment with red/yellow/green flags and quantified impact

Actionable 100-day plan recommendations to accelerate post-close GTM performance

Why Craig Group?

Move forward confidently thanks to quantitative data, revenue operations and a hands-on approach that goes well beyond analysis.

Access the proven expertise of GTM operators familiar with all phases of the process.

Benefit from our deliberate focus on lower middle market private equity.

Leverage our ability to deliver quickly while working seamlessly with your team.

De-Risk Deals and Start Growing on Day One

Don't let gaps in your GTM strategy jeopardize your next deal or stall a profitable exit.