How PE-Backed CROs and CS Leaders Fix Net Revenue Retention Fast: Territory Discipline + Time-to-Value

Most PE-backed companies treat closed-won as the finish line. Account executives celebrate the booking and move on, assuming customer success will handle everything from there. Customer Success inherits accounts with unclear expectations, incomplete discovery, and buyers who aren’t sure what they purchased.

By the time churn risk becomes visible, it’s too late to fix the root cause. The problem wasn’t that Customer Success failed to retain the account. The problem was that sales closed a deal that was never set up to succeed.

Net revenue retention doesn’t start at renewal. It starts the moment sales qualifies an opportunity. The fastest path to strong net revenue retention requires account executives and customer success managers to align on territory discipline and time-to-value execution in January, before quota pressure forces reactive behavior.

Why Closed-Won Is Just the Beginning of Execution Risk

In PE-backed companies, bookings only matter if they turn into retained and expanded revenue. A deal that churns within 12 months didn’t create value. It created cost, distraction, and explanation at the Board level.

The pattern is predictable. Account executives chase every opportunity to hit coverage targets, pushing deals through without confirming fit, usage commitment, or executive sponsorship. Contracts get signed, but expectations are misaligned from day one.

Customer success inherits these accounts and discovers what was sold doesn’t match what the buyer thought they were getting. Onboarding stalls because the champion who signed isn’t responsible for implementation. Usage stays low because the problem wasn’t painful enough to drive adoption.

By renewal, trust is already broken. Customer success can’t save an account that was poorly qualified and messily closed.

January is when both roles establish the operating rhythm that prevents dirty closes, accelerates time-to-first-value, and builds the foundation for expansion.

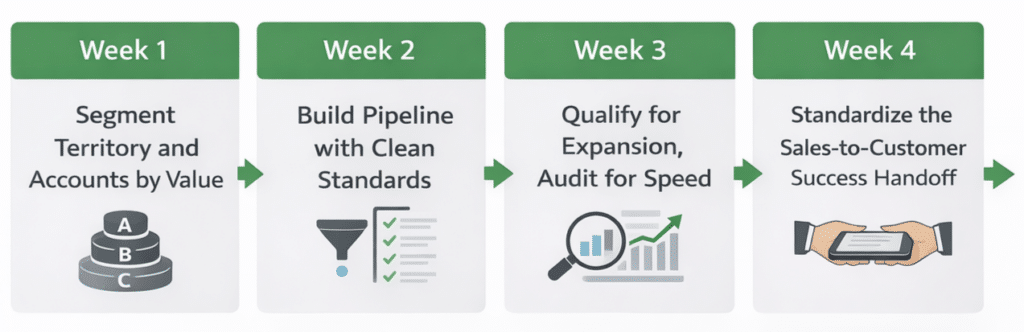

The Four-Week Operating Rhythm for Full Customer Lifecycle

Week 1: Segment Territory and Accounts by Value

Account executives segment their territory into A, B, and C accounts based on ideal customer profile fit, deal size, and conversion history. A-tier accounts get focused effort. B-tier accounts receive standard treatment. C-tier opportunities get disqualified early.

Customer success managers segment existing accounts by annual recurring revenue, expansion potential, and health indicators. High-value accounts with renewal risk get proactive executive engagement. Growth accounts get mapped for expansion plays. At-risk accounts get intervention plans before churn becomes inevitable.

Week 2: Build Pipeline with Clean Standards

Account executives build pipeline with accounts that match ideal customer profile and demonstrate buying readiness. Every opportunity has documented next steps, clear timelines, and contact within 24 hours of the last interaction. Deals lacking momentum or executive access get disqualified.

Customer success managers redesign quarterly business reviews from status updates into outcome-focused impact reviews that demonstrate measurable results, connect product usage to business outcomes, and surface expansion opportunities based on proven value.

Week 3: Qualify for Expansion, Audit for Speed

Account executives update discovery to assess expansion potential during the sales process. Deals get scored not just on initial contract size but on growth indicators like multi-department need, executive sponsorship, and usage commitment.

Customer success managers audit onboarding workflows to identify where time-to-first-value is slowing down. They eliminate unnecessary steps, clarify success criteria, and ensure new customers see measurable outcomes within the first 30 days.

Week 4: Standardize the Sales-to-Customer Success Handoff

Week 4 establishes the shared lever that protects net revenue retention: a clean handoff from sales to customer success.

Both roles align on what information must transfer when a deal closes: buyer pain points, success criteria, decision-making structure, usage commitment, and expansion indicators. Deals don’t get handed off until these details are documented and reviewed.

Customer success receives accounts with clear context. Sales stays accountable for deal quality beyond the signature. The weekly handoff review becomes the forcing function that prevents dirty closes and ensures onboarding starts with alignment rather than confusion.

Why This Matters for Portfolio Value

PE buyers evaluate companies on net revenue retention as much as new bookings. Strong net revenue retention signals product-market fit, customer satisfaction, and scalable growth. Weak net revenue retention indicates revenue is leaking faster than it’s being added.

Companies that use January to align account executives and customer success managers on territory discipline, time-to-value, and handoff standards see measurable improvements in retention and expansion velocity. Churn drops because deals are qualified correctly from the start. Expansion accelerates because customer success inherits accounts already demonstrating value.

The alternative is spending another year where sales optimizes for bookings regardless of fit, customer success fights to retain poorly qualified accounts, and both teams blame each other when net revenue retention stays flat.

Download The January Fast Start Guide for PE-Backed GTM Teams and use the account executive and customer success manager Week 1 to 4 plays to protect retention and build expansion capacity.

In January, you either architect the customer lifecycle or you spend the rest of the year explaining why revenue didn’t compound the way the model projected.