From Good to Great: The Hidden Cost of “Good Enough” in PE-Backed Businesses

In Private Equity, business value is rarely lost in a single catastrophic event. Instead, it erodes quietly – missed opportunity by missed opportunity as go-to-market (GTM) capabilities deliver average performance rather than being upgraded early in the hold period to reach their full potential.

Many lower middle-market (LMM) companies enter PE ownership with functioning GTM systems that deliver acceptable results. Revenue grows. Deals close. Pipelines look healthy. But “acceptable” is the enemy of value creation in PE with such high growth expectations.

PE sponsors – and the next buyer – pay for a predictable revenue engine and EBITDA expansion within a finite hold period. When critical GTM capabilities aren’t intentionally upgraded early in the hold, growth doesn’t just stall-it systematically underperforms the model.

The Math That Should Keep You Up at Night

Consider a PE-backed $70M B2B services business operating over a 6-year hold period. Using the Sales Velocity formula:

Sales Velocity = (Number of Opportunities × Win Rate × ACV) ÷ Sales Cycle Length

Now assume the company fails to materially upgrade key GTM levers early in the hold:

- Average Contract Value (ACV) grows modestly at inflation

- Sales Win Rate remains flat

- Sales cycle times don’t improve

Over the 6-year hold, this missed opportunity compounds into tens of millions in unrealized revenue, slower EBITDA growth, reduced cash generation, and less predictable performance.

At exit, the math is unforgiving. At a high multiple, even modest underperformance can translate into $50M-$100M+ in lost equity value.

But early investment in even a single GTM capability can reverse this trajectory. For example, a 15% improvement in sales win rate-driven by better data discipline, ICP analytics, and RevOps support-increases annual closed revenue that compounds throughout the hold and translates into tens of millions in incremental enterprise value at exit.

The difference between a good exit and a great exit often comes down to one question. Did you act early enough?

Why “Good” GTM Capabilities Fail to Scale in PE

Founder-led GTM systems create hidden constraints that become growth limiters under PE ownership. Data is inconsistent or underutilized. ICPs evolve without discipline. Sales velocity is measured, not managed. Pricing remains unsophisticated. Knowledge lives in people, not systems. Training and coaching are ad hoc. And a DIY mindset stalls progress that experts could accelerate.

Revenue still grows in these environments, but inefficiently. And inefficiency quietly suppresses win rates, margin expansion, rep productivity, forecast accuracy, EBITDA leverage, and buyer confidence at exit.

PE sponsors don’t just buy growth-they buy confidence that future growth will be delivered predictably and efficiently. That confidence comes from systems, not heroics.

Eight Critical GTM Capabilities That Separate Good Exits from Great Ones

Not all GTM improvements are created equal. Some capabilities create the foundation that enables others to deliver maximum impact. When improved from good to great, these eight capabilities create a sustainable revenue engine that drives faster growth and commands higher exit multiples.

Capability #1: CRM/Data Discipline & RevOps

This is the non-negotiable starting point. Everything else fails without clean data and systems.

What “Good” Looks Like: In typical scenarios, the CRM exists but is used primarily as a reporting tool. Data quality is unreliable with duplicated records, Ideal Customer Profile (ICP) definition is anecdotal rather than data-driven, segmentation is broad and inconsistent, opportunities aren’t prioritized by economics, win-rate drivers are unknown, and forecasting is directional at best.

What “Great” Looks Like: The CRM becomes the system of record and operating system. Data is clean, trusted, and continuously validated. ICP is defined by real performance metrics. Segmentation is economically driven, targeting is prioritized by opportunity quality, funnel math is understood end-to-end, and forecasting becomes reliable (making your CFO and Board happy).

How to Bridge the Gap:

1.) Conduct an immediate CRM audit and data cleanup

2.) Establish data governance standards and enforcement

3.) Implement a RevOps function (even if just one person initially)

4.) Build shared funnel definitions across Marketing, Sales, and CS

5.) Deploy AI-powered analytics to surface patterns

6.) Create a territory design based on opportunity density

7.) Align quotas to capacity and cycle times

8.) Tie incentives to profitable growth, not just volume

Why This Is Capability #1: RevOps builds the operating infrastructure for revenue scaling. Without data discipline, you’re making critical growth decisions blind. Territory planning, quota setting, ICP refinement, pricing strategy, and performance coaching all fail without reliable data.

Capability #2: ICP Focus & Segmentation

With clean data in place, you can now identify where you actually win and where you waste resources.

What “Good” Looks Like: ICP definitions are broad and loosely enforced, qualification is flexible and often overridden, and SMB, Mid-Market, and Enterprise accounts are treated as equals despite different economics. Pipeline volume is rewarded more than quality, and reps chase buyers that “feel reasonable.”

What “Great” Looks Like: ICPs are narrow, documented, and evidence-based. Definitions are embedded inside the CRM with enforcement, stage exit criteria reflect best-fit buyer behavior, and off-ICP deals are filtered early, not negotiated late. Win-loss analysis continuously sharpens ICP focus, and reps concentrate where economics and velocity are strongest.

How to Bridge the Gap:

1.) Analyze historical win/loss data by segment, deal size, and industry

2.) Document specific ICP criteria based on actual performance

3.) Embed ICP requirements into CRM qualification stages

4.) Establish hard stop criteria for off-ICP opportunities

5.) Train Marketing and Sales on strict ICP adherence

6.) Conduct monthly win-loss reviews to refine ICP

7.) Reallocate resources toward best-fit segments

Why This Matters: Great ICP discipline doesn’t reduce opportunity-it removes distraction. When teams sell to “best-fit” buyers, win rates stabilize and improve, deal sizes increase naturally, sales cycles shorten, and forecasts become more reliable.

Capability #3: Sales Velocity as an Engineered Lever

With data and ICP locked down, sales velocity transforms from a lagging KPI into a manageable system.

What “Good” Looks Like:

Velocity is reviewed monthly or quarterly (not weekly), teams focus on total revenue rather than deal flow quality, pipeline progression is assumed rather than verified, the CRM is used for reporting instead of decision-making, and deals are chased reactively, often off-ICP.

What “Great” Looks Like: Velocity is measured weekly by rep, segment, and ICP. It’s tracked through four controllable levers: opportunity volume, win rate, ACV, and sales cycle length. Each lever is actively improved through better Marketing, new processes, pricing, product bundling, and training/coaching. Velocity becomes a management system, not just a metric.

The Sales Velocity Improvement Math:

Assume a $70M B2B services business with:

- 1,000 opportunities per year

- 25% win rate

- $100K ACV

- Annual closed revenue = $25M

Now improve velocity by influencing controllable levers:

- Win rate improves from 25% → 30% (through clarified ICP, sales training, new website)

- Sales cycle shortens by 10% (through better leads, sales negotiation training)

- Without adding pipeline or headcount

These changes alone drive several million dollars of incremental annual revenue. Over a multi-year hold, the gains compound dramatically.

How to Bridge the Gap:

1.) Establish weekly sales velocity tracking dashboard

2.) Decompose velocity into the four controllable levers

3.) Assign ownership for improving each lever

4.) Run controlled experiments on cycle time reduction

5.) Implement lead scoring to improve opportunity quality

6.) Use conversation intelligence AI to identify bottlenecks

7.) Create feedback loops from closed deals to Marketing

Capability #4: Documented Sales Processes

Tribal knowledge doesn’t scale. Documented playbooks do.

What “Good” Looks Like: Sales stages exist but don’t reflect actual buyer commitment or risk. Deals advance without evidence of buyer alignment, the CRM records activity instead of deal health, forecasts rely on rep confidence rather than proof, and coaching reacts to misses instead of preventing them.

What “Great” Looks Like: Buyer-driven stages are defined, documented, and updated in playbooks. Exit criteria and execution steps are explicit and enforced, qualification, discovery, and validation are standardized, the CRM supports playbook adherence (not just reporting), and coaching targets specific deal mechanics.

How to Bridge the Gap:

1.) Document your best reps’ winning behaviors by deal stage

2.) Create explicit exit criteria for each stage (what must be true to advance)

3.) Build sales playbooks with talk tracks, objection handlers, and qualification questions

4.) Embed playbooks into CRM workflows

5.) Certify reps on playbook execution

6.) Use AI conversation review to monitor adherence

7.) Update playbooks quarterly based on win/loss data

Capability #5: Talent Alignment & GTM Team Fit

Systems require the right people to execute them. Culture determines how those people perform.

What “Good” Looks Like: Roles exist but overlap heavily, a few reps carry an outsized load (hero culture), accountability varies by individual, hiring is subjective and relationship-driven, training is informal or inconsistent with virtually no coaching, active sales funnel management is limited, and compensation is commission-heavy and misaligned to strategy.

What “Great” Looks Like: GTM roles are clearly defined by motion, segment, and deal complexity. Talent is matched to the growth strategy, performance standards are explicit, measurable, and enforced, hiring prioritizes A-team talent with modern GTM experience, training is structured, continuous, and tied to real deals, Sales Managers actively coach and elevate performance, and accountability is clear and visible via dashboards.

How to Bridge the Gap:

1.) Map current roles against required capabilities

2.) Identify skill gaps and role overlaps

3.) Create role clarity documents (RACI charts)

4.) Establish performance standards with clear metrics

5.) Upgrade hiring criteria to match growth strategy needs

6.) Build structured onboarding and continuous training programs

7.) Train managers on coaching methodologies

8.) Align compensation to strategic priorities (not just closed revenue)

Why This Matters: Processes create structure, but scalable growth and premium exit value come from aligned talent executing within a high-performance culture.

Capability #6: Pricing Sophistication

Pricing works best AFTER core GTM upgrades are in place. Attempt it too early and you risk customer churn.

What “Good” Looks Like: Cost-plus pricing was set years ago, one-size-fits-all price lists dominate, there’s limited packaging or bundling, discounting happens to close late-stage deals, and pricing is driven by intuition.

What “Great” Looks Like: There’s clear linkage between price, customer value, and outcomes. Pricing is differentiated by ICP, size, and use case. Tiered structures are designed to anchor buyers upward, explicit discount guardrails align to strategy and margins, controlled pricing pilots run before broad rollout, and ongoing pricing optimization compounds ACV and EBITDA.

Pricing Plays That Drive ACV Expansion:

- Tiered packages → natural upsell paths (+5-15% ACV)

- Solution bundling → expand share of wallet (+5-12% ACV)

- Value-based pricing → align price to ROI (+10-20% ACV)

- Segmented pricing → capture willingness-to-pay (+5-15% ACV)

- Usage or outcome-based pricing → align cost to value (+8-18% ACV)

How to Bridge the Gap:

1.) Conduct pricing analysis by segment and customer value

2.) Build tiered packaging with clear differentiation

3.) Create value calculators to justify price points

4.) Establish discount approval workflows

5.) Run controlled pricing pilots in select segments

6.) Train Sales on value-based selling and price justification

7.) Monitor pricing impact on win rates and churn

Why Sequencing Matters: Weak messaging creates unclear differentiation, which forces focus on pricing differences. Secure GTM fundamentals first, then optimize pricing to limit customer churn.

Capability #7: Customer Success & Expansion Revenue

One of the highest-ROI GTM levers-and the most underutilized in LMM businesses.

What “Good” Looks Like: The focus is on onboarding and issue resolution, accountability is limited to renewals, expansion is surfaced ad hoc, there’s a weak Sales-to-CS handoff, training happens once, adoption is loosely tracked, and quarterly business reviews (QBRs) – if they happen – don’t discuss impact.

What “Great” Looks Like: There’s clear ownership for retention AND expansion, defined upsell and cross-sell motions by segment, proactive success plans tied to outcomes, structured Sales-to-CS handoffs with goals and risks documented, ongoing training aligned to use cases, time-to-first-value tracked and optimized, adoption monitored to speed value realization, expansion driven by usage and value signals, and consistent QBRs scheduled and focused on impact.

Why Customer Success Matters: Expansion revenue delivers lower CAC, higher win rates, shorter sales cycles, stronger retention, and qualified referrals.

How to Bridge the Gap:

1.) Establish upsell and cross-sell framework and training

2.) Create lifecycle-based expansion plays

3.) Build CS playbooks defining when and how to expand

4.) Set revenue goals for CS team members

5.) Implement structured Sales-to-CS handoff process with “Mutual Success Plans”

6.) Track and optimize time-to-first-value

7.) Align CS data, incentives, and messaging with Sales and Marketing

8.) Monitor buyer’s remorse signals and intervene early

Critical Success Factors:

Sales-to-CS Handoff: Customer goals and buying rationale must be documented. Mutual Success Plans clarify responsibilities on both sides, and risks and expansion opportunities are identified upfront.

Time-to-First-Value: Faster onboarding reduces buyer’s remorse and anchors retention and expansion. Slow adoption creates drag that weakens renewals, reduces expansions, and kills referrals.

Capability #8: GTM Training & Coaching as a Force Multiplier

In many cases, GTM execution resembles the Wild West-few standards, limited oversight, and inconsistent buyer experiences. Most PE-backed LMM businesses don’t lack strategy. They lack GTM teams trained to consistently execute it.

What “Good” Looks Like: Training consists of occasional workshops or one-off sessions with minimal reinforcement or coaching, no certifications or structured evaluation, informal change management, and messaging that varies by individual-confusing buyers.

What “Great” Looks Like: Training is structured and recurring across Sales, Marketing, and CS with certifications to ensure adoption and proficiency. There’s reinforcement through repetition, coaching that lifts MIDDLE performers toward top-tier standards, manager monitoring with audits and AI conversation review, training tailored by buyer type and market segment, alignment with value-based selling, SPICED, and CS cross-selling frameworks, and sales wins and CAC that improve without adding headcount.

The Risk of Inconsistent GTM Training:

- Slower rep ramp times

- Resistance to change initiatives

- Inconsistent Sales, Marketing, and CS messaging

- Lower conversion rates and ACVs

- Unpredictable revenue growth and inaccurate forecasts

- Pressure on exit multiples

How to Bridge the Gap:

1.) Start early – PE hold periods are limited

2.) Focus training on defined market segments (SMB, MM, or ENT)

3.) Embed coaching into change management processes

4.) Use AI-driven dashboards to monitor execution quality

5.) Align Marketing, Sales, and CS around ONE buyer narrative

6.) Certify all GTM team members on core frameworks

7.) Implement ongoing coaching programs for middle performers

8.) Create manager accountability for team development

Why This Matters: When every buyer interaction counts, great GTM training ensures those interactions are effective, repeatable, and scalable-creating the consistent execution that builds sustainable revenue engines.

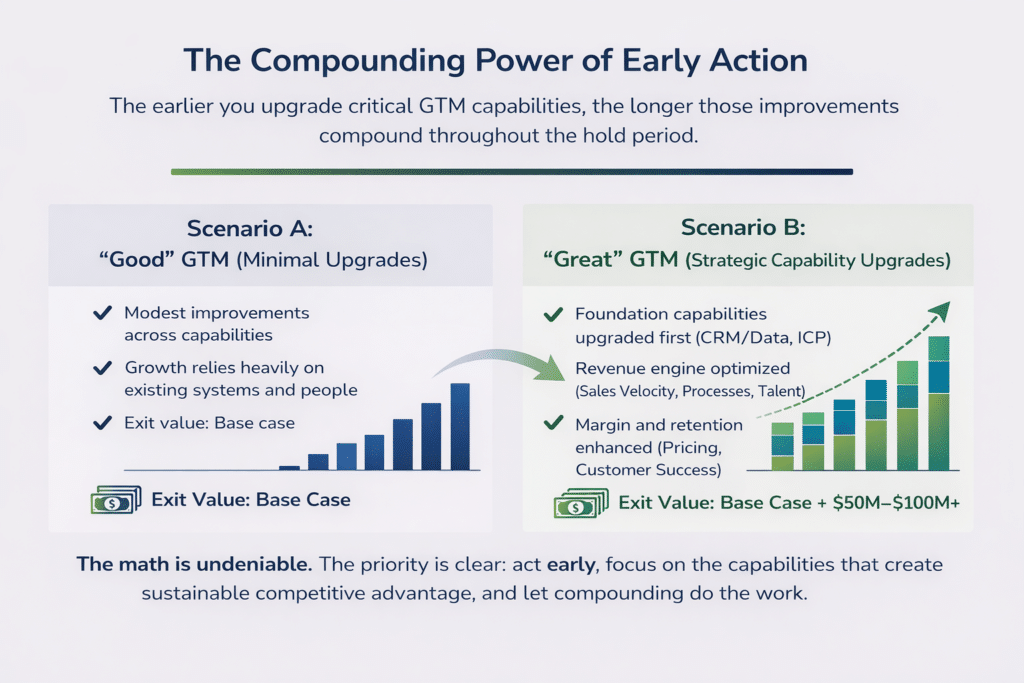

The Compounding Power of Early Action

The earlier you upgrade critical GTM capabilities, the longer those improvements compound throughout the hold period.

Consider the difference in outcomes:

Scenario A: “Good” GTM (Minimal Upgrades)

- Modest improvements across capabilities

- Growth relies heavily on existing systems and people

- Exit value: Base case

Scenario B: “Great” GTM (Strategic Capability Upgrades)

- Foundation capabilities upgraded first (CRM/Data, ICP)

- Revenue engine optimized (Sales Velocity, Processes, Talent)

- Margin and retention enhanced (Pricing, Customer Success)

- Execution consistency achieved (Training & Coaching)

- All improvements compound into predictable, scalable growth

- Exit value: Base case + $50M-$100M+ in incremental equity value

The math is undeniable. The priority is clear: act early, focus on the capabilities that create sustainable competitive advantage, and let compounding do the work.

Why PE Firms Must Act Now

In PE-backed lower middle-market businesses, every buyer interaction matters. Yet growth models often assume execution consistency that doesn’t exist in reality.

Differentiation is critical-especially in competitive markets. And yet, leaving interactions with key buyers to chance creates risk.

When hold periods are finite, great GTM capabilities ensure buyer interactions are effective, repeatable, and scalable. The companies that win aren’t the ones with the best strategy on paper-they’re the ones that execute with discipline from day one.

Good Is the Enemy of Great

PE sponsors don’t buy businesses hoping for average performance. They buy growth potential-but that potential only converts to value when GTM capabilities move from good to great.

The path to sustainable revenue growth:

1.) Start with data and systems (CRM/RevOps)

2.) Focus your efforts (ICP)

3.) Engineer velocity (manageable sales system)

4.) Document your Sales playbook (remove tribal knowledge)

5.) Align your people (talent + culture)

6.) Optimize for margin (pricing)

7.) Expand effectively (Customer Success cross-sell/upsell)

8.) Multiply through training across GTM (consistent execution)

Every day you wait to upgrade critical GTM capabilities is a day of compounding value left on the table. In PE, that’s a cost you can’t afford.

Ready to move your portfolio businesses from good to great? The Craig Group specializes in helping PE-backed LMM businesses upgrade critical GTM capabilities to create sustainable revenue engines. Let’s talk about how to capture the full value of your hold period – before it’s too late.

Brian Gustason is a growth-focused operator & advisor with a proven record of driving accelerated revenue and EBITDA growth for lower- to mid-market B2B services and technology businesses. He specializes in transforming Private Equity portfolio companies through stronger leadership, GTM excellence, team development, and value-creation initiatives, leading to higher exit multiples. Follow him on LinkedIn.