The Role of a Business Growth Advisor in Private Equity Success

Private equity firms are all about finding great opportunities, growing businesses, and delivering strong investor returns. But, let’s be honest, it’s not just about throwing money at a business and hoping for the best.

Success requires a smart mix of strategy, operational expertise, and forward-thinking guidance. That’s exactly where a business growth advisor steps in to help you craft a solid revenue growth plan and implement winning business growth strategies.

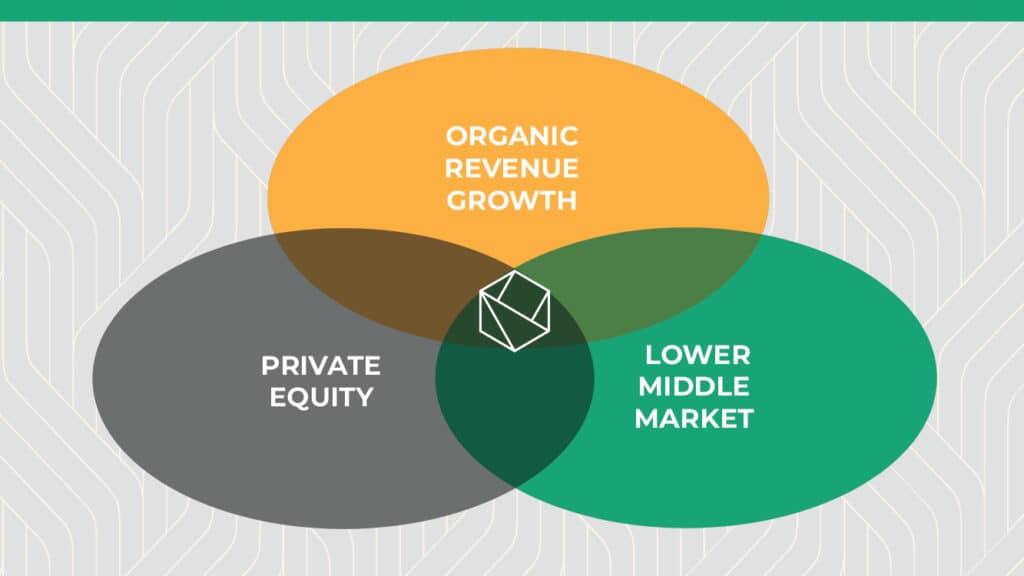

At Craig Group, we work exclusively with PE-backed, lower middle-market businesses to help them grow faster and smarter. What sets us apart? We bring a unique understanding of the critical intersection between organic revenue growth, private equity, and the lower middle market. When it comes to being a portfolio company, value creation is key. That’s why our team of experienced advisors focuses on driving sustainable growth and delivering maximum investor returns for each and every client.

If you’re in the private equity space, this guide will give you a clear view of how the right growth advisor can drive transformative results in your portfolio companies.

What is a Business Growth Advisor?

Think of a business growth advisor as your strategic sidekick. They’re experts in operations, sales, and marketing, who come in to spot growth opportunities and develop tailored revenue growth plans to help businesses scale. The goal? Improve profitability, increase market share, and boost enterprise value over the long run. Being a portfolio company, value creation and maximum investor returns are always top of mind. That’s where a business growth advisor comes in – they help you achieve your goals and unlock the full potential of your investments.

For private equity firms, growth advisors can be difference makers at a critical time. After an acquisition, they help portfolio companies reach their next level. By balancing short-term wins with long-term strategy goals, they offer a roadmap to consistent growth and impressive returns.

Why Private Equity Firms Need Business Growth Advisors

1. Strategic Direction and Market Insight

When private equity firms acquire a business, understanding the nuances of the industry becomes critical. This is where growth advisors like Craig Group are needed. We bring industry expertise to the table, conduct in-depth market research, and keep an eye on market shifts to ensure strategies remain effective.

For instance, take a manufacturing company that’s seeing a rise in demand but isn’t quite sure who its best customers are, or how to find more of them. A growth advisor might start by helping them define their ideal customer profile (ICP), then build a revenue plan focusing on reaching the right markets with the needed product.

Using a portfolio company, value creation plans and business strategy can help businesses gain market share by identifying lucrative opportunities and leveraging their strengths in the marketplace. We can also assist with pricing strategies, competitive analysis, and product positioning to ensure our clients are maximizing their potential profitability.

2. Accelerating Revenue Growth

Every private equity firm’s mission is faster revenue growth. That’s why growth advisors focus on creating data-driven strategies to ramp up sales and profits. Some of their go-to moves include:

- Optimizing Pricing Models: Adjust pricing to maximize margins without losing customers.

- Expanding Distribution Channels: Spot untapped markets or partnerships that open up new revenue streams.

- Improving Customer Retention: Implement loyalty programs and strategies to keep customers coming back.

With these strategies in play, portfolio companies can grow faster and deliver lasting value.

3. Operational Enhancements

Scaling a business requires a solid foundation, and operational efficiency is key. Growth advisors know how to pinpoint inefficiencies and fix them to drive progress.

Consider a logistics company that is falling short because of a clunky, outdated sales process, relying on spreadsheets, slow follow-ups, or inconsistent messaging. A growth advisor could streamline the entire sales funnel by introducing a CRM, tightening up the pitch, and building a repeatable outreach strategy. The result? A faster, more consistent sales cycle that drives real revenue growth.

4. Aligning Management with Broader PE Goals

Here’s a common challenge private equity firms face: getting the leadership team of a portfolio company to align with PE goals. Growth advisors act as the bridge, ensuring both sides are working together seamlessly.

They identify gaps in management skills, offer coaching, and fine-tune workflows to improve performance. With everyone rowing in the same direction, success becomes much easier to achieve. When it comes to portfolio companies, value creation in this area is key for PE firms looking to maximize their returns. They must ensure that management teams are aligned with the broader goals of the firm and have the necessary skills to execute on growth strategies.

5. Managing Risks During Growth

Growth is exciting, but it can expose businesses to risks like overextension or financial instability. Growth advisors take a proactive approach, using data and scenario modeling to anticipate challenges and implement solutions before they escalate. Craig Group’s Conduit™ – our tech-enabled service and proprietary model – aligns marketing and sales resource allocation with key revenue drivers. It’s like a safety net for your growth goals.

How Craig Group Can Help

At Craig Group, we specialize in creating customized business growth strategies for private equity teams and their portfolio companies. Whether you need help crafting a strong revenue growth plan or improving sales efficiency and win rates, we’re here for middle market wins.

Our tailored solutions are designed to generate measurable results. Interested in seeing what that could look like for your business? Portco executives, book a one-on-one with us here. Together, we can turn your big growth goals into reality.

When it comes to being a portfolio company, value creation and revenue growth are top priorities. However, achieving these goals can be challenging without a clear plan and the right resources in place.

Time to Accelerate Your Growth

Business growth advisors are the secret weapons behind private equity success. With expertise in strategy, operations, and revenue growth roadmaps, they help businesses scale smarter and faster while reducing risks along the way. Our team at Craig Group brings years of experience and a proven track record of success to guide your portfolio company towards achieving its full potential.

Through data analysis, market research, and in-depth industry knowledge, we work closely with you to identify key growth opportunities and develop a customized roadmap that aligns with your business goals.

It’s time to level up. If your private equity firm is ready to unlock the full potential of its portfolio companies, reach out to the team at Craig Group. We’d love to show you how the right business growth strategies can deliver the results you’re looking for. Contact us today to learn more and start accelerating your growth.

Business Growth Advisor, Business Growth Houston TX, Craig Group Growth Strategies, Growth Consulting for PE Firms, Operational Efficiency Private Equity, PE Portfolio Company Growth, Private Equity Growth Strategy, Revenue Growth Plan, Scaling Portfolio Companies, Strategic Growth Advisory