Why Focus Is the Most Underrated Go-To-Market Advantage in 2026

As we enter 2026, many PE-backed lower middle-market companies are feeling a familiar tension: the pressure to grow is back, but the tolerance for inefficiency is not.

Capital markets may be thawing, but board expectations remain high. In this environment, the companies that outperform won’t be the ones that “do more.” They’ll be the ones who do fewer things exceptionally well.

Across portfolio conversations, one theme keeps resurfacing: lack of focus is quietly killing otherwise strong go-to-market engines.

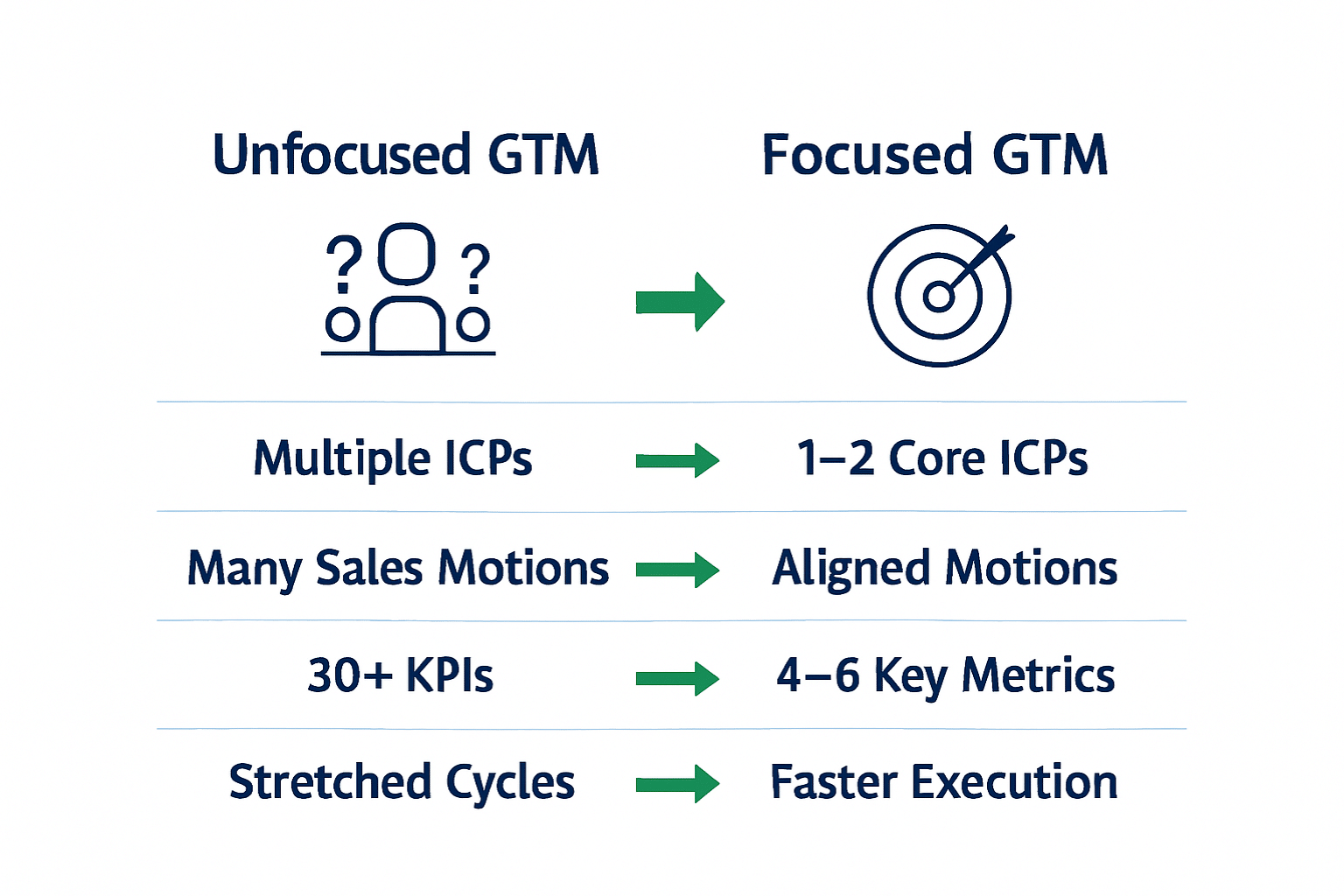

It usually doesn’t show up as a strategy problem. Leadership teams have a plan. The issue shows up in execution – too many verticals, too many use cases, too many buyer types, and too many sales motions running in parallel. The result is a GTM model that looks busy but produces inconsistent results.

In 2026, maintaining focus is no longer a philosophical debate. It’s a performance requirement.

Buyers are more risk-aware, purchasing decisions involve more stakeholders, and switching costs – real or perceived – are higher. When your message tries to speak to everyone, it rarely resonates with anyone. Sales cycles stretch, discounts creep in, and pipeline quality deteriorates.

The highest-performing PE-backed teams are responding with coherence, not complexity.

They are making deliberate choices about:

Where to win: The best companies concentrate on one or two core ICPs, clearly defined by firmographics, use cases, and buying triggers. Instead of selling “manufacturing ERP” to anyone with a factory, they target $50M-$200M discrete manufacturers with legacy systems who are facing a succession event or compliance pressure. This specificity allows marketing to speak directly to known pain points, sales to pattern-match opportunities faster, and product to build features that matter most. When you know exactly who you’re built for, every function moves faster.

How to win: Leading teams deploy a small number of sales motions that align to buyer risk, not internal org charts. A company selling mission-critical software to regulated industries might use an enterprise motion with multi-threading, proof of concept, and executive sponsorship – even if deal sizes are mid-market. Meanwhile, a workflow tool with low switching cost and fast time-to-value runs a velocity motion with product-led trial and a single economic buyer. The point isn’t complexity versus simplicity. It is alignment between how you sell and how your customer buys. Mismatches here create friction that no amount of hustle can overcome.

How to measure success: High-performers track a tight set of metrics reviewed weekly, with clear accountability. Instead of monitoring 30 KPIs across a dashboard, they focus on four to six that actually predict outcomes: pipeline creation by ICP, qualification velocity, win rate by motion, and expansion rate by cohort. Each metric has an owner, a weekly review cadence, and a clear action protocol when numbers drift. This discipline surfaces problems early and keeps the team calibrated on what matters most.

Clarity creates momentum. Marketing generates fewer but better leads. Sales qualifies faster and walks away sooner. Customer success knows exactly what “value delivered” looks like. Forecasts improve because the business is no longer trying to be everything at once.

For PE-backed leadership teams, focus also creates a better equity story. A coherent GTM model is easier to scale, easier to explain, and easier for the next owner to underwrite. Investors value businesses they can understand quickly and replicate predictably.

In 2026, growth isn’t about expanding the surface area of your GTM strategy. It’s about sharpening it.

Focus isn’t a constraint. It’s the advantage.

Ajay Joshi is a Partner at Craig Group, specializing in revenue operations for PE-backed industrial companies. With over 20 years of experience across manufacturing, industrial services, and B2B sectors, he helps leadership teams build predictable, scalable revenue engines. Connect with him on LinkedIn.