Craig Group Conduit™: See Your Growth Options Before You Commit

You’re facing a decision with real stakes.

Should you hire two more sales reps or put that budget into marketing? Should you expand into a new region or focus on your current markets? Is it better to find new customers or grow existing accounts?

Your CFO asks for a forecast. Your PE partners want to review the growth plan. The board expects to see clear options and trade-offs.

Right now, getting answers can take weeks. Someone builds an Excel model using last quarter’s numbers. Sales has one view of the pipeline, while marketing tracks different goals. By the time you show three scenarios to the board, the assumptions have already changed.

This is the problem Craig Group Conduit™ solves.

What Conduit Actually Does

Conduit™ is Craig Group’s AI-powered scenario modeling capability for PE-backed, lower-middle-market companies that need board-ready growth plans on a PE timeline. It’s designed for businesses in the $25M to $350M revenue range across healthcare, industrials (including manufacturing), software/SaaS, and B2B services.

Instead of starting with a static spreadsheet, Conduit™ helps you build a living baseline by connecting CRM, marketing, and finance inputs so you can see how the business really performs.

It brings your sales, marketing, and finance data together in one interactive workspace. Instead of building separate forecasts in different spreadsheets, you can model growth scenarios in real time, compare outcomes side by side, and make decisions based on your real business dynamics.

Conduit™ works like a flight simulator for revenue decisions. You can test different options and see the results before you commit budget or make a hire.

In early Conduit™ engagements, sessions have identified 10–15% growth improvements and millions in potential EBITDA impact by reallocating resources more effectively, often without adding spend.

In one workshop, a client found $3 million in potential EBITDA just by moving budget from low-performing to higher-return activities.

As Summer Craig, Managing Director of Craig Group, explains: “Conduit™ gives leadership teams the ability to model these choices before the quarter begins, seeing how every lever impacts performance, capacity, and profitability.”

Why Normal Planning Tools Don’t Work for GTM

Most financial planning tools assume a simple formula: spend X dollars, wait Y months, get Z result.

But go-to-market planning isn’t that simple.

If you hire two sales reps today, there is a ramp-up period – usually 3 to 6 months – before they are productive. During that time, you need enough qualified leads to keep them busy, or you end up paying for unused capacity.

If you raise your marketing budget by 50%, you won’t automatically get 50% more customers. Results depend on which channels you use, your current conversion rates, your sales team’s capacity, and the length of your sales cycle.

If you’re a contract manufacturer getting 2 leads per month with a 15% win rate and $30K average deals, can you grow just by doing more marketing? Or should you improve your conversion rate first? What if you raise your win rate to 38% but don’t get more leads? What if you do both?

Conduit models how your business really works, not just the simplified version you see in a spreadsheet.

See and Do in Conduit

Here’s what a typical Conduit session looks like:

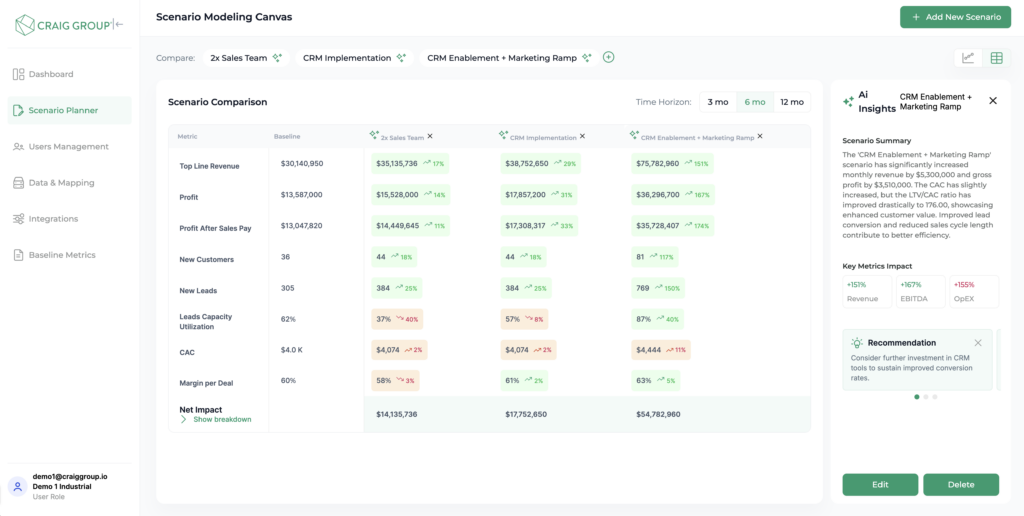

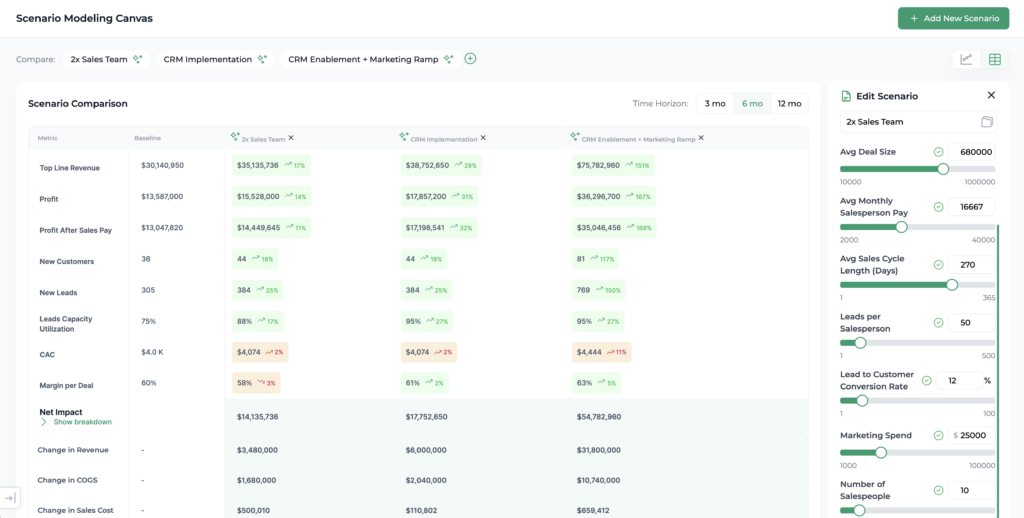

You start by setting up scenarios. Maybe you’re comparing three options: “2x Sales Team,” “CRM Implementation,” and “CRM Enablement + Marketing Ramp.”

For each scenario, you specify the assumptions – how many salespeople you’re adding, what you’ll pay them, how long until they’re productive, your average deal size, sales cycle length, marketing spend, and expected conversion rate improvements.

Then Conduit models the outcomes. You can compare scenarios side by side across 3, 6, and 12-month horizons and see exactly what changes when you adjust the levers.

- Top line revenue and how it compares to baseline

- Profit (not just revenue – actual profit accounting for costs)

- New customers and new leads

- Lead capacity utilization (are you generating more pipeline than your team can handle?)

- Customer acquisition cost (CAC)

- Margin per deal

- Net impact (the bottom-line dollar difference from baseline)

The numbers are color-coded. Green shows you’re ahead of baseline. Red or orange signals a concern.

Pay attention to what appears. Conduit highlights constraint problems you might otherwise miss.

In one scenario, lead capacity utilization might drop to 37%. That’s a red flag that you’ve built more sales capacity than your pipeline can support, meaning you’re paying for headcount that can’t be productive. In another scenario, utilization might rise to 95%+. That can look great until you realize the team is maxed out, follow-up slows, and growth becomes fragile if demand increases or a rep turns over.

These are not just hypothetical problems. They happen in real businesses every day, but you often don’t see them until it’s too late. Dashboards usually show “leads generated” and “deals closed,” but not how capacity and demand relate to each other.

The net impact line tells the real story.

Scenario A projects $14M impact. Scenario B shows $17M. Scenario C hits $54M. Same baseline. Same timeline. Completely different outcomes based on where you invest.

The Questions Conduit Helps You Answer

“Should we hire more sales reps or invest in marketing?”

Conduit shows you what happens. If you hire reps but don’t increase your pipeline, your cost per deal rises and utilization drops. If you boost marketing but don’t add sales capacity, leads go unworked. The best option might be to add one rep and increase marketing by 30%. Conduit helps you see that middle path you might not have considered.

“We’re in a competitive industrial market, getting undercut on price. How do we grow without destroying margin?”

Model what happens if you improve your win rate from 15% to 38% through better qualification and value-based selling. Even if lead volume stays flat, how does that change revenue, profit, and CAC? Then model the combination: better win rate plus targeted lead generation in higher-margin segments. The net impact might be 3X higher than either approach alone.

“We’re growing fast in healthcare services but our customer acquisition cost is climbing. Where’s the inefficiency?” Conduit lets you see CAC by channel and segment. You might find you’re spending $50K on a channel that brings in lots of low-conversion leads, while spending $10K on a channel with three times better conversion. Move that $40K and see how your CAC and profit change. That’s how one client found $3M in EBITDA without spending another dollar.

“We’re a SaaS company considering expanding to enterprise deals. What does that do to our model?”

Enterprise deals have longer sales cycles, higher deal values, and different conversion rates. Model it: What if your average deal size goes from $50K to $200K, but your sales cycle goes from 90 days to 270 days, and you need more senior reps at higher pay? Does the math work at 3 months? 6 months? 12 months?

“Our board wants 30% growth. What’s the realistic path?”

Build three scenarios that each deliver 30% growth through different levers. One focuses on volume (more leads, more reps). One focuses on efficiency (higher conversion, bigger deals). One focuses on expansion (upselling existing customers). Each hits the revenue target – but they have very different profit implications, cost structures, and risk profiles.

The Hidden Value: Efficiency Before Scale

Something that has surprised leadership teams in early Conduit sessions is that the biggest opportunities often aren’t about doing more. They’re about doing what you already do, but doing it better.

That client who found $3 million in EBITDA? They weren’t missing a growth opportunity. They were spending the budget on activities with poor returns while underfunding activities that were working.

Conduit made that visible by tracking outcomes, not just activity.

Most dashboards show: “We generated 500 leads this month.” But what if 300 of those leads convert at 3%, while 200 convert at 18%? You’re treating them the same in reporting, but they have completely different economics.

For companies in competitive industrial or manufacturing markets, where you can’t simply spend more to grow because margins are tight, this focus on efficiency is critical. It’s how you grow profitably instead of just growing.

Where Conduit Fits in Your Journey

The benefit of Conduit is that it’s useful at multiple stages.

Starting point: Maybe you’re a healthcare or B2B services company with steady revenue but no clear growth plan. Conduit can be your first step, helping you model different paths and choose the one that fits. From there, you might work with Craig Group for Catalyst™ (strategic GTM planning) or Ignite™ (hands-on execution).

Mid-journey: You’ve done the foundational work. You know your ICP, your positioning, and your priorities. Now you’re asking, “How do we achieve the targets we committed to?” Conduit helps you build realistic, defensible plans that consider capacity, ramp time, and constraints.

Scale mode: You’ve built the engine and things are working. Now you’re asking, “Where do we invest next for the best return?” Conduit shows you which levers to pull and which ones look attractive but have hidden downsides.

Exit prep: You’re 12-18 months from exit and need to show how you’ll hit the revenue target that supports the exit multiple. Conduit gives you scenario-based plans you can defend in diligence.

Conduit isn’t tied to a specific sequence. It’s helpful any time you need to make an important resource allocation decision and want to see your options clearly.

What Makes Conduit Different

It’s built by operators with years of experience. Craig Group’s team has a proven track record, helping PE-backed companies improve revenue operations in healthcare, industrial, software, and B2B services. That expertise is built into Conduit.

When Conduit flags a concern about lead capacity utilization or suggests you’re overspending in a low-conversion channel, it’s not just generic AI making guesses. It’s real operational experience built in.

It reflects how GTM really works. Most planning tools use simple math, but Conduit understands ramp curves, capacity limits, channel saturation, conversion rate changes, and sales cycle friction. It models real situations, not just textbook examples.

It’s made for the middle market. It replaces spreadsheets with dynamic scenario planning and creates a single source of truth across revenue functions, so finance, sales, ops, and marketing stay aligned on the same plan.

It links planning to execution. Since Craig Group handles both strategic planning (Catalyst) and hands-on execution (Ignite), Conduit is more than a modeling tool. The scenarios you create can become your execution roadmap.

What You Get With Conduit

When you engage with Conduit™, you get an operator-led planning process supported by AI-powered modeling, not a static forecast or a one-time spreadsheet build.

A typical engagement includes:

- Scenario development workshop to identify the 3-5 scenarios worth modeling

- Data integration connecting Conduit to your CRM, marketing platforms, and financial data

- Interactive modeling sessions where you adjust variables and see impacts in real time

- Board-ready documentation with visual comparisons and clear trade-offs

- Ongoing tracking of actuals vs. projections so you can course-correct when needed

You leave with confidence that your plan is based on real data, not just hope.

The Bottom Line

Most growth plans fail not because the strategy was wrong, but because they were built on assumptions that didn’t hold up in reality.

You modeled “hire two reps” but didn’t account for ramp time. You invested in demand gen but didn’t realize your sales team was at capacity. You chased revenue without tracking margin erosion.

Craig Group Conduit™ helps you see these dynamics before you commit the resources.

It shows you what happens at 3, 6, and 12 months. It highlights constraints you might miss. It models trade-offs so you can choose between real options, not just guess. And it gives you board-ready documentation that turns “I think we should…” into “Here’s why this path delivers the best return.”

Whether you’re in healthcare, industrial manufacturing, software, or B2B services, and whether you’re just starting your growth plan or improving an existing one, Conduit gives you the clarity to invest with confidence.

If you’re allocating growth resources in the next 3-12 months and need a plan you can defend to your board or sponsor, Conduit™ helps you see before you decide.

Ready to see your options? Request a Conduit demo.

EBITDA optimization, Private Equity Value Creation, Revenue Growth Planning, Scenario-Based Financial Modeling, go-to-market strategy