Anatomy of a Deal: Inside a Rapid Lower Middle Market Success Story

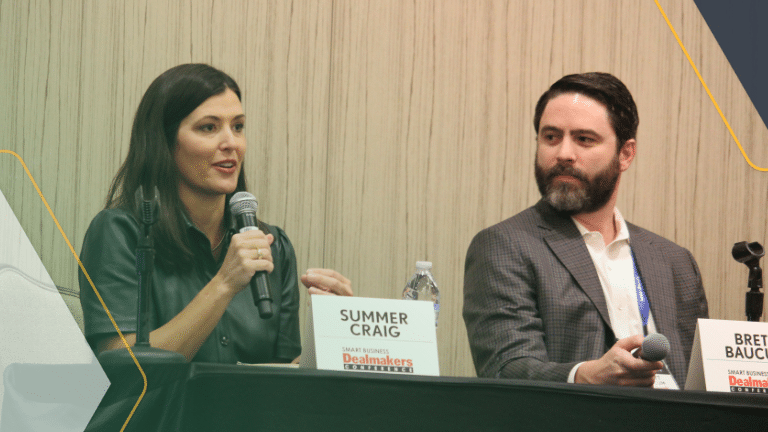

At the recent Houston Smart Business Dealmakers conference, Brett Baucum and Alejandro Capetillo of Agile Growth Equity, Sean Muller, CPA from Weaver, and Summer Craig from Craig Group walked through the entire lifecycle of the Kobus Pipe Puller transaction, from sourcing to exit in 15 months. The discussion offered valuable insights into the realities of lower middle-market private equity.

The Hunt for the Right Deal

Deal sourcing in the lower middle market requires persistence and relationship building. As independent sponsors, Baucum and Capetillo spent some time finding the right opportunity.

But patience paid off when they were introduced to a UK-founded company with remarkable technology for municipal infrastructure—specifically, replacing lead water service lines without traditional trenching methods.

The product was immediately compelling. As Craig noted, “When you see it, you immediately understand what it does and you immediately realize that every municipal utility in the whole entire country needs to buy twenty of these machines.” That product-market fit made the complex deal structure worth pursuing.

Untangling International Complexity

The structural challenges were significant: approximately 60 individual shareholders across the UK, an international corporate structure with US operations generating most revenue but UK-based manufacturing and IP, and the need to restructure into a more efficient holding company format.

Muller highlighted a key challenge for independent sponsors: “When you talk about due diligence, they’re an independent sponsor. They don’t have endless amounts of money. So how do you cost-effectively do due diligence on a deal? Because for tax, it doesn’t matter if this is a ten-million-dollar deal or a hundred-million-dollar deal. The issues are still there.”

Working with Muller and specialized tax advisors in both the US and UK, they successfully completed what became known as “de-sandwiching” the companies, a term that stuck throughout the process.

Rolling Up Sleeves for Value Creation

Post-close operational improvements required hands-on work. The CEO was a talented engineer who had built strong processes, but those processes needed to be more scalable. The CRM system was a very detailed system of binders organized by customer, month, and year.

“That is a CRM, by the way,” Baucum noted. “He had all the information.”

The first priority was hiring financial leadership to free up both the CEO and the private equity team for strategic work. Then came go-to-market transformation: implementing proper CRM systems, modernizing sales materials, building a sales team, and creating scalable processes with Craig Group’s support.

Implementing formulaic incentive structures proved transformational. Within twelve months, EBITDA grew from $2 million to $3.25 million.

Creating Your Own Luck

Sometimes the best exits aren’t planned—they’re cultivated. Just two months after closing, a chance dinner conversation with an executive from a much larger industry player evolved over the following year, progressing from knowledge-sharing to channel partnership discussions and ultimately to acquisition interest.

They signed the acquisition agreement in January 2025 and closed in April, which was just before significant trade policy changes that could have complicated the transaction, given the company’s European supply chain.

The Independent Sponsor Advantage

The panelists emphasized their competitive advantage: availability and willingness to do operational work. “We don’t have to go deploy a hundred million dollars a year,” Capetillo explained. “We get to be selective… and put [in] projects that we want to work on that allow us to do the value creation stuff.”

The transaction earned Deal of the Year recognition at last year’s conference—a testament to what’s possible when operational expertise meets strategic partnership and a willingness to tackle complexity others avoid.